Figure 1

Government supports and limited spending opportunities during the pandemic led American households to accumulate more cash savings than they usually keep, and they have been depleting these savings ever since.1 As their excess cash reserves dwindle, households will likely cut back on spending, and they may be more susceptible to financial shocks. In aggregate, decreased spending and increased financial vulnerability could slow the economy. The JPMorganChase Institute Household Finances Pulse uses de-identified administrative banking data from 7.8 million Chase customers to measure these changes in Americans’ cash balances and how much excess savings these households still hold.2

Extending our data through June 2024, we find that all but the lowest-income households continue to deplete their cash savings, and balance levels may be slightly below historical expectations. While balance decreases have slowed, saving rates remain negative for all but the lowest income households.3 As a result, balances may now be below historical expectations: compared to historical data, households may now have lower cash savings than they would have had absent the pandemic.

While this change in the relative trajectory of balances is noteworthy, two observations provide important context for its interpretation. First, historical trends may not be directly comparable to more recent data as the macroeconomic environment has changed. In particular, elevated interest rates in recent years have led financially savvy households to allocate greater proportions of their liquid balances to higher-earning accounts. We observe these increased transfers to higher-yield accounts as continued declines in checking and savings account balances and note that total cash reserves may be higher than what we observe in checking and savings accounts alone. Second, our two historical samples exhibit differences in relative balance trends, making it difficult to establish a single counterfactual against which we can assess the current state of the Pulse sample. Still, the balances we observe are at most aligned to the lowest of the benchmarks we assessed and continue to show year-over-year declines.

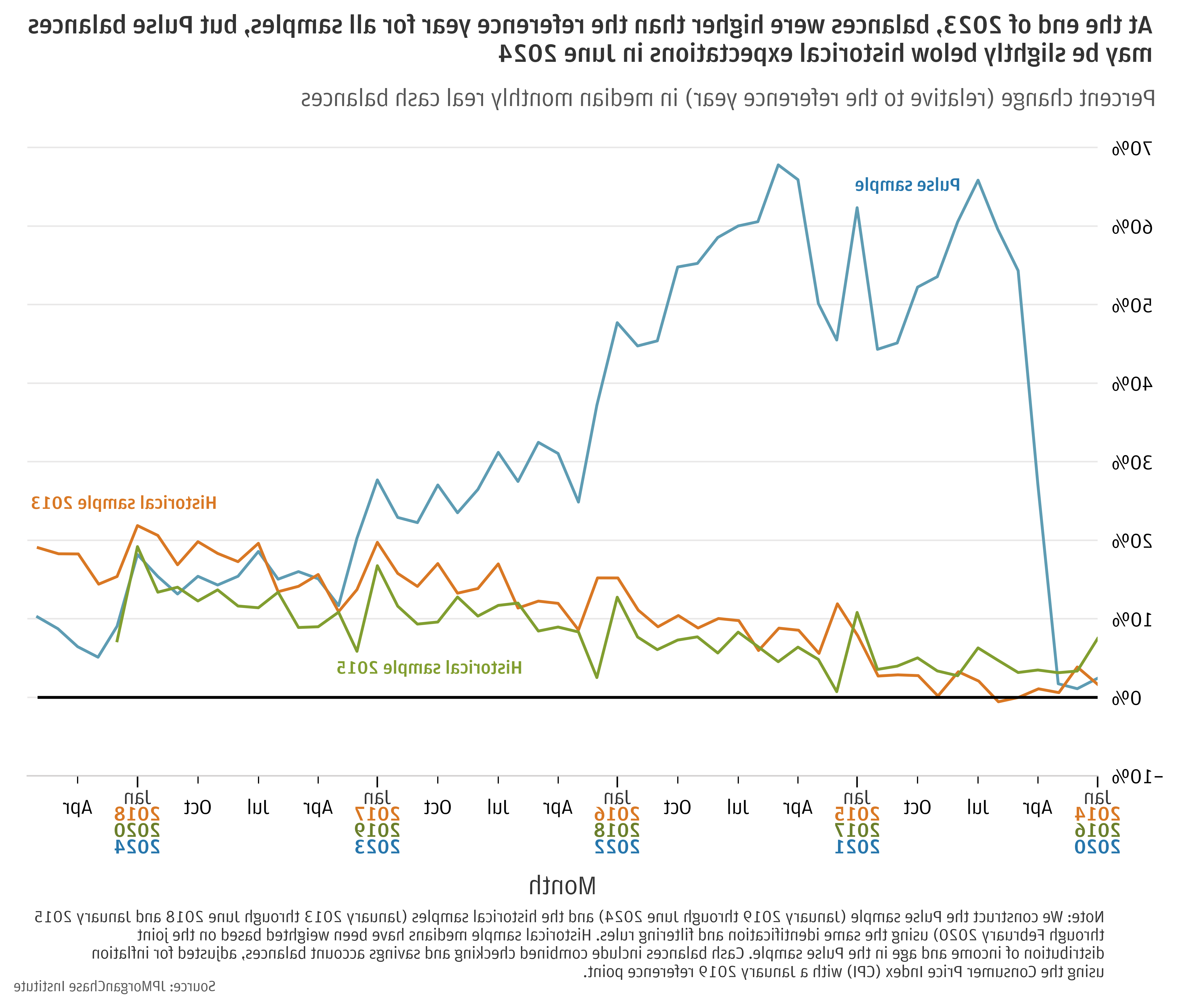

To understand current balances in the context of households’ expected life-cycle growth, we examine real balance changes for our Household Finances Pulse sample compared to two pre-pandemic samples.4 As households age, their incomes tend to increase and they tend to spend and save more, typically resulting in higher cash balances. Our comparison samples demonstrate these aging dynamics outside of the context of the COVID pandemic and its associated policy responses, helping to put recent balance results into perspective.

Figure 1 shows relative balance growth—percent change in monthly median balance relative to the same month in each sample’s reference year—for the Pulse sample and the two historical comparison samples. This approach provides a relatively clear comparison of cumulative balance gains since the onset of COVID as compared to prior periods. It illustrates, for instance, that the elevated balances of 2020 and 2021 persisted at least through the end of 2022 relative to historical trends. Moreover, it suggests that balances were likely at least in line with historical trends through year-end 2023—balances at the end of the fifth year relative to the reference year were 14 to 20 percent higher across samples (2023 for the Pulse sample; 2019 and 2017 for the historical samples). However, this approach provides a less clear view of relative balance growth in more recent months. Our latest data in June 2024 show the relative balances for the Pulse sample were only 10 percent above the reference year (the middle of the sixth year), whereas the 2013 historical sample was nearly 20 percent above its reference year at that time. However, seasonality and the exhaustion of the 2015 historical sample make it difficult to determine whether balances in June 2024 are below both reference series.

Figure 1

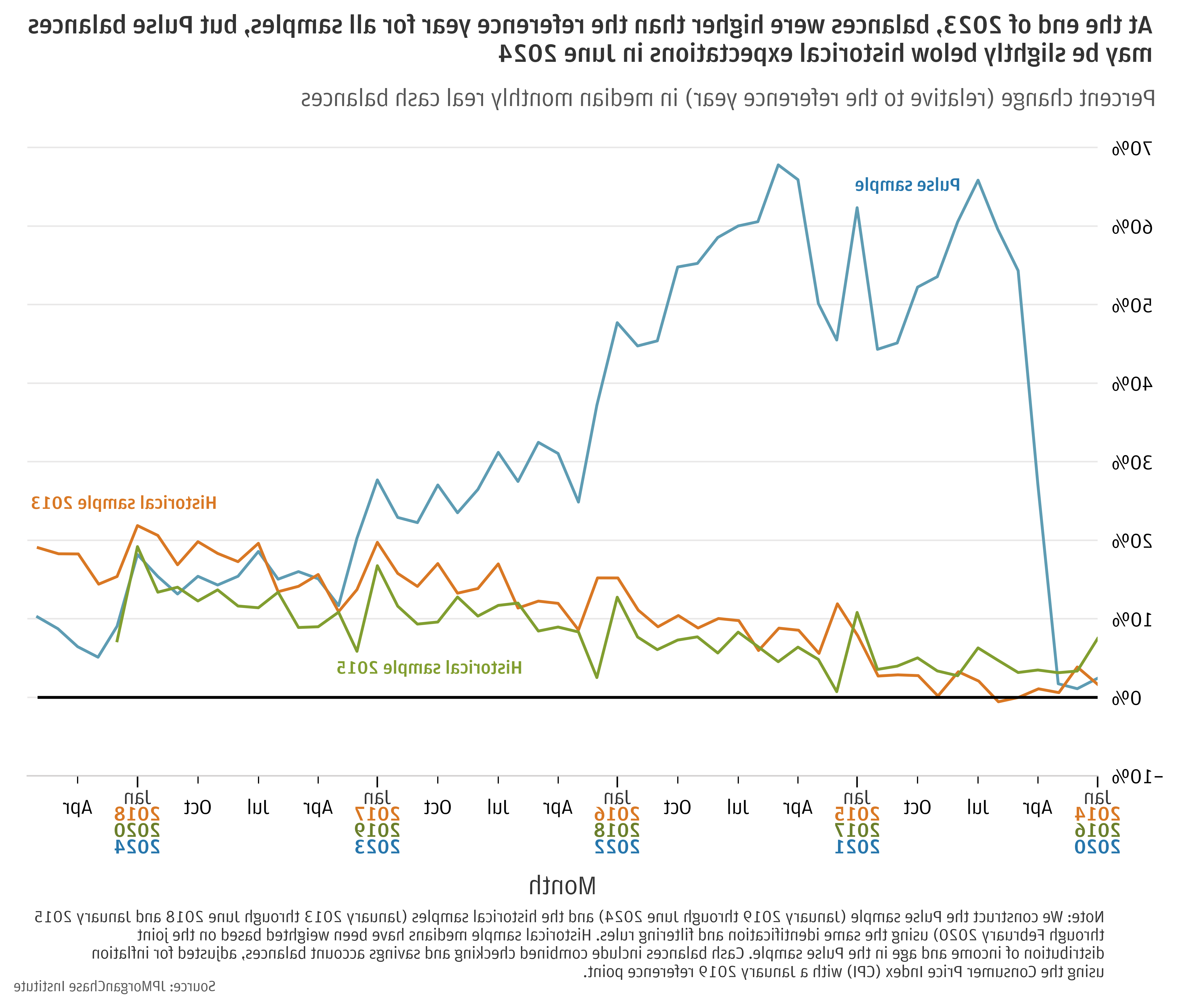

Figure 2 provides a perhaps clearer view of relative balance trends in recent months by showing year-over-year balance growth—percent change in median monthly balance relative to the same month in the prior year—for the Pulse sample and the two historical comparison samples. The historical series show that households tend to steadily increase cash savings over time, with monthly median balances generally elevated over the prior year, typically by 2 to 6 percent. For the Pulse sample, we observe very high year-over-year balance growth during 2020 and early 2021 when pandemic-era government supports historically increased cash savings. In mid-2021, balance growth turned negative relative to the prior year as households began spending down their elevated cash reserves. From 2022 onward, year-over-year balance changes have been negative but on an upward trajectory as dissaving slows. As households shift behavior away from spending down pandemic-era excess cash toward more typical savings behaviors, year-over-year balance changes should continue to increase. Based on the current trajectory, we only expect a few more months of negative balace growth, and given that relative balances are at best level with historical expectations (as seen in Figure 1), this suggests that balances will soon be below historical expectations. However, the trends in Figure 2 also suggest dissaving may only continue for a few more months , potentially limiting the extent of deviation from balance expectations . As we see in Figure 3, the lowest income households may have already stopped dissaving.

Figure 2

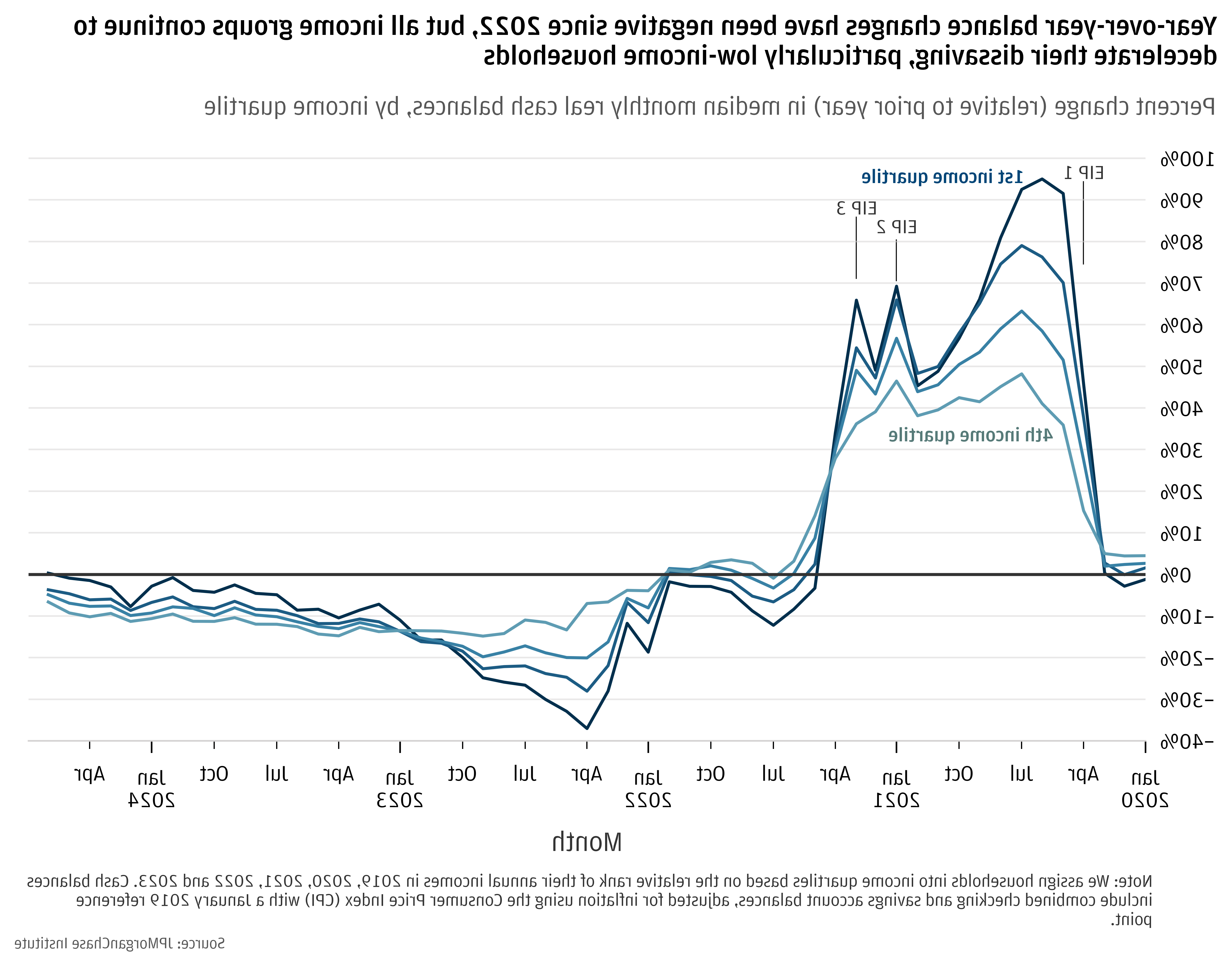

Dissaving trends vary by income as shown in Figure 3, which tracks year-over-year balance growth by income quartile.5 (For balance levels and relative balance growth by income quartile, see Appendix Figures A1 and A2.) Across income quartiles, we observe very high year-over-year balance growth during 2020 and early 2021, turning negative in mid-2021 as households began depleting their elevated cash reserves. From 2022 onward, year-over-year balance changes have been negative but on a steep upward trajectory for low-income households. In contrast, high-income households followed a much flatter trajectory during that period. While high-income households lag their low-income counterparts, all groups continue to decelerate their dissaving.

Figure 3

Finally, Figure 4 shows year-over-year balance growth by race and ethnicity.6 (For balance levels and relative balance growth by race and ethnicity, see Appendix Figures A3 and A4.) Year-over-year balance changes have been on comparable upward trajectories for all groups after shifting into negative values in early 2022. Black and Hispanic households experienced slightly greater balance declines than Asian and White households in the spring of 2022. The four groups converged in 2023, with year-over-year balance changes remaining negative but on similar upward trajectories. In June 2024, all race groups had cash balances 3 to 5 percent below that of the prior year. As with our earlier results by income, balances across race and ethnicity groups continue to decline year-over-year, though at slower rates than in previous years.

Figure 4

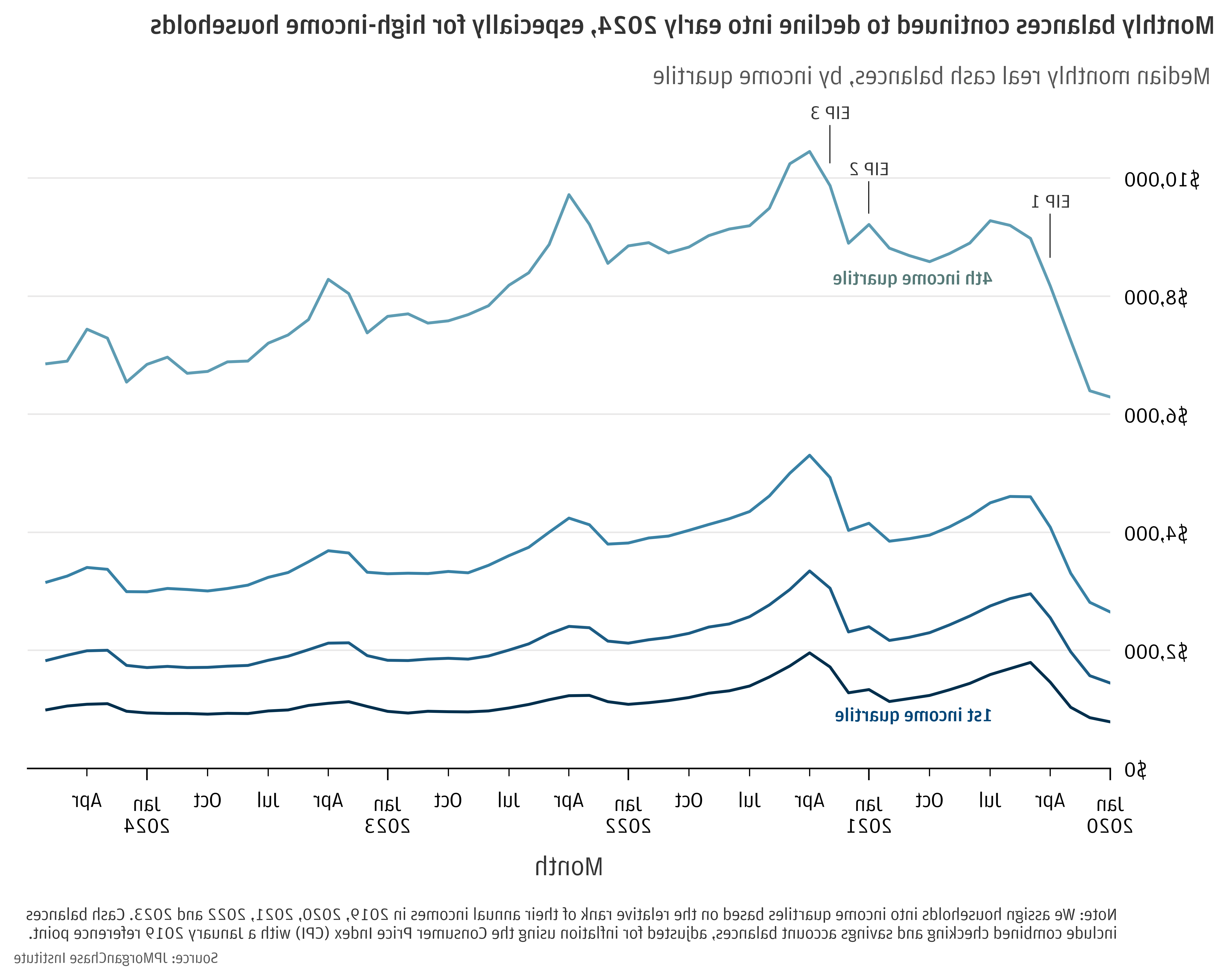

Figure A1

Figure A2

Figure A37

Figure A4

Figure A5

We thank our research team, specifically Peichen Li, for their hard work and contribution to this research. Additionally, we thank Alfonso Zenteno and Annabel Jouard for their support. We are indebted to our internal partners and colleagues, who support delivery of our agenda in a myriad of ways and acknowledge their contributions to each and all releases.

We are also grateful for the invaluable constructive feedback we received from external experts and partners. We are deeply grateful for their generosity of time, insight, and support.

We would like to acknowledge Jamie Dimon, CEO of JPMorgan Chase & Co., for his vision and leadership in establishing the Institute and enabling the ongoing research agenda. We remain deeply grateful to Peter Scher, Vice Chairman, Tim Berry, Head of Corporate Responsibility, Heather Higginbottom, Head of Research & Policy, and others across the firm for the resources and support to pioneer a new approach to contribute to global economic analysis and insight.

This material is a product of JPMorganChase Institute and is provided to you solely for general information purposes. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the authors listed and may differ from the views and opinions expressed by J.P. Morgan Securities LLC (JPMS) Research Department or other departments or divisions of JPMorgan Chase & Co. or its affiliates. This material is not a product of the Research Department of JPMS. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which is provided for illustration/reference purposes only. The data relied on for this report are based on past transactions and may not be indicative of future results. J.P. Morgan assumes no duty to update any information in this material in the event that such information changes. The opinion herein should not be construed as an individual recommendation for any particular client and is not intended as advice or recommendations of particular securities, financial instruments, or strategies for a particular client. This material does not constitute a solicitation or offer in any jurisdiction where such a solicitation is unlawful.

Wheat, Chris, Erica Deadman, Daniel M. Sullivan. 2024. “Household Finances Pulse through June 2024: Balances Continue to Decline.” JPMorgan Chase Institute. http://passport.landaiztc.com/institute/all-topics/financial-health-wealth-creation/household-pulse-balances-through-june-2024

During the pandemic, the federal government provided cash assistance and relief to households through a range of fiscal interventions. Three rounds of stimulus, or Economic Impact Payments (EIP) provided cash benefits to households earning below specified income thresholds, with payments landing in April 2020, January 2021, and March 2021. Throughout this time, expanded unemployment insurance delivered payments to jobless workers, including gig workers and self-employed workers, with weekly supplements to typical benefits which were phased out in 2021. Finally, the American Rescue Plan increased the dollar amount of Child Tax Credit (CTC) payments and disbursed half of the credit via monthly advance payments from July through December 2021.

http://home.treasury.gov/policy-issues/coronavirus/assistance-for-american-families-and-workers/economic-impact-payments

http://tcf.org/content/report/7-5-million-workers-face-devastating-unemployment-benefits-cliff-labor-day/

http://www.whitehouse.gov/child-tax-credit/

Our Household Finances Pulse data asset covers 7.8 million families who were active checking account users between January 2019 and June 2024 and had at least $12,000 in annual adjusted income—non-transfer inflows into the checking accounts, minus Economic Impact Payments (EIP) and Unemployment Insurance (UI)—deposited to their Chase checking accounts every year in 2019 through 2023.

To address inflation and an associated decrease in the purchasing power of households’ cash reserves, we report real cash balances rather than nominal cash balances. We compute real cash balances by deflating nominal cash balances by the Consumer Price Index (CPI), with January 2019 as our reference point. See Figure A5 for a comparison of nominal and real balances.

http://fred.stlouisfed.org/series/CPIAUCSL

Sample filters are applied to ensure the households in our sample use their Chase accounts as primary vehicles for managing their finances. See details in End Note 2. Our Pulse sample is constructed from households that were active Chase accountholders between January 2019 and June 2024 (reference year 2019 for relative balance comparisons). We apply the same identification and filtering rules to construct two comparison samples: the historical comparison sample used in our prior release, covering January 2015 through February 2020 (reference year 2015), and a new sample covering January 2013 through June 2018 (reference year 2013). We added this second historical sample because the 2015 sample could not be extended without overlapping with the start of the pandemic in March 2020, and we wanted to include a historical sample that covered the full 66-month timeframe of our Pulse sample. To account for differences in sample composition, historical sample medians have been weighted based on the joint distribution of income and age in the Pulse sample.

We assign households to income quartiles using the methodology introduced in the June 2022 Pulse release (see “Box: Our updated income metrics”). This method uses our adjusted income metric—non-transfer inflows into the checking accounts, minus Economic Impact Payments (EIP) and Unemployment Insurance (UI)—and calculates each household’s relative rank across income for each year in our sample, averaging ranks to determine final quartile.

We use a modeled race metric, classifying households into race groups based on the racial distribution of their Census tract. We weight median balances to account for differences in income, age, and gender across race groups.

We weight median balances to account for differences in income, age, and gender across race groups, and continue to see clear level differences in weighted medians. Income disparities by race are large and persistent in the U.S., where Asian and White households have notably higher incomes than Hispanic and Black households. Because higher incomes often result in higher cash balances, we facilitate comparisons between race groups by weighting the medians we report based on each group’s joint distribution of income, gender, and age.

http://www.census.gov/content/dam/Census/library/visualizations/2021/demo/p60-273/figure1.pdf

Chris Wheat

President, JPMorganChase Institute

Erica Deadman

Consumer Research Lead

Daniel M. Sullivan

Consumer Research Director, JPMorganChase Institute